The advertised annual percentage rate may vary based on creditworthiness and terms. (1) The advertised ARP (annual percentage rate) is a fixed rate for a loan term of no more than 12 years (144 months), requires a first lien position against your home, and 100% LTV* (Loan to value). (2) Home Equity Lines of Credit are variable-rate loans. Rates are based on an evaluation of credit history, CLTV (combined-loan-to-value) ratio, loan amount and occupancy, so your rate may differ. The plan has a maximum APR of 18%. Under no circumstances will the APR go below the floor during the term of the loan . Rate may adjust monthly with the Prime rate as published in The Wall Street Journal. We will use the most recent index value available to us as of 10 days before the date of any annual percentage rate adjustment. Rates subject to change.

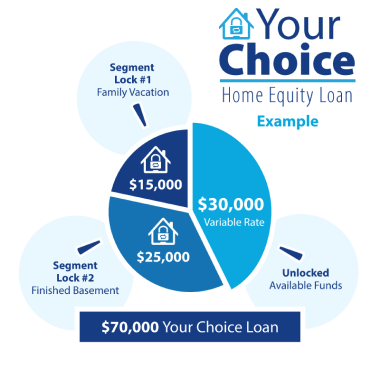

**Credit is subject to approval. This account provides the option to convert some or all of the outstanding balances from a variable APR to a fixed APR during the draw period for terms from 5 to 20 years. Terms and conditions apply. See credit union for details. Refinancing of existing Dover Federal Loans may not be available. The Fair Housing Act, makes it illegal to make or publish any advertisement that indicates any preference, limitation, or discrimination based on race, color, religion, sex, handicap, familial status, or national origin. Please check here for more information. Consumer access to the Nationwide Mortgage Licensing System and Registry. A list of current Dover Federal Mortgage Loan Originators is available upon request. Consumers may access the registry via the web at NMLS consumer accessor they may contact the NMLS Call Center at (240) 386-4444. The latest HMDA data about our residential mortgage lending, as modified by the Consumer Financial Protection Bureau to protect applicant and borrower privacy, is available online for review on the Bureau’s website at www.consumerfinance.gov/hmda. A paper copy can be obtained by submitting your written request to Dover Federal Credit Union, 1075 Silver Lake Blvd, Dover, DE 19904.